How A Bill Becomes Law

It may be exciting to hear about Congress introducing immigration bills, particularly if it may benefit you, your

family members, or friends, however, it’s important to have realistic expectations about the legislative process. Most immigration bills introduced in Congress never become laws. Moreover, Congress has not passed major immigration reform legislation in decades. Below we will explain the multi-step process that a bill must go through before it becomes an enacted law.

What Is A Bill?

A “bill” is proposed legislation that has not yet become a law.

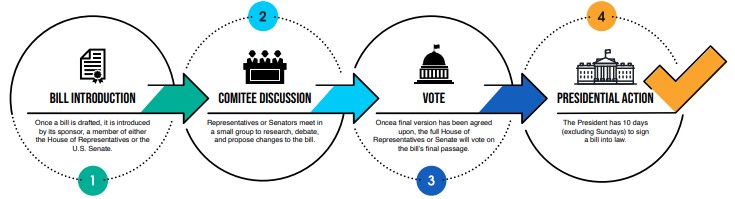

The Bill Is Introduced

Once a bill is drafted, it is introduced by its sponsor, a member of either the House of Representatives or the U.S.

Senate, and given the corresponding legislative number of either ‘H.R.’ or ‘S’. Once introduced, bills can be

found at https://www.congress.gov.

The Bill Goes To Committee

Representatives or Senators meet in a small group to research, debate, and propose changes to the bill. They vote

to accept or reject the bill and its changes before sending it to the House or Senate floor for debate, or to a subcommittee for further research. Each piece of legislation is referred to the committee that oversees the specific area affected by the bill. For immigration issues, that usually is homeland security, judiciary, or appropriations committee.

A public hearing is often conducted in which members hear testimony from witnesses who are subject matter

experts. The bill is typically then considered in a “mark-up” session where members of the committee review the

bill in great detail. Amendments to the bill may be offered, and committee members will vote to accept or reject

the changes.

At the end of the markup, a vote is taken to determine whether the bill will be reported out of the

committee or whether no further action will be taken. If a bill is reported out of the committee, a report

is written which describes the purpose and scope of the measure as well as the committee’s reasons for

recommending approval.

Congress Votes On The Bill

Once a final version has been agreed upon, the full House of Representatives or Senate will vote on the

bill’s final passage. Typically, bills must pass with a 2/3 majority vote, but in some instances a majority

vote is sufficient. If one chamber passes the bill, it moves to the other chamber (either the House

of Representatives or the Senate) to go through a similar process of committee review, debate and

amendment. When a bill has been approved by the House and Senate with different provisions, it must

go to a conference committee consisting of a select group of both House and Senate members who are

responsible for resolving the differences and reporting the bill back to both chambers for a vote.

The Bill Goes To The President

Once the bill passes both the House of Representatives and the Senate, it goes to the President for

approval or veto. The President has 10 days (excluding Sundays) to sign a bill into law.

- If the President approves the bill, they sign it, at which point it becomes law.

- If the President does not agree with the bill:

- The President vetoes the bill, returns it to Congress with an explanation of the reasons for rejection. If two-thirds of both chambers of Congress then vote for the bill to be passed anyway, they can override the veto and the bill will become law.

- The President can also choose to take no action. If Congress goes out of session within the 10-day period following the bill’s formal delivery to the President, the bill will not become law. This is known as a pocket veto.

Questions About Family-Based Immigration Or An Immigration Bill?

If you or a family member have any questions about Family-Based Immigration or the effect an Immigration Bill may have on you or a family member, speak with a qualified immigration lawyer. Request a free immigration consultation with immigration attorney Jessie M. Thomas today.

Printable Flyer on How A Bill Becomes Law

View online, download, or print and share with others

Resources

- United States House of Representatives: The Legislative Process: https://www.house.gov/the-house-explained/the-legislative-process

- usa.gov: How Laws are Made and How to Research Them https://www.usa.gov/how-laws-are-made